Crypto is inevitable

... if you take the longer term view (and ignore the bear market)

Public opinion often thinks of crypto either as a passing fad caused by price speculation, or as primarily the work of a few exceptional individuals (e.g. Satoshi or Vitalik). For crypto enthusiasts, the second perspective is acceptable but somewhat unsatisfying, as it implies a degree of fragility. How would progress in the space have looked without the contributions of those individuals?

Historical analysis can examine changes either in terms of individual actions or larger forces transcending individuals (e.g. technological, social, political). In many cases, the forces matter more than the individuals. For example, you could argue that ridesharing would exist in some form today even if the founders of Uber and Lyft were never born, as the rise of cell phones & GPS meant the inefficiency of walking around to hail taxis was bound to disappear. Adopting a similar tactic for crypto, viewing crypto instead through the lens of long term trends rather than individual actions presents a stronger argument for its viability.

Crypto is not an isolated movement, but has drawn heavily from developments in cloud computing and open source. Blockchains with smart-contract capabilities can be viewed as an evolution of cloud computing - although both involve running code on other people’s computers, blockchains provide better support for composability and the sharing of data. Separately, blockchains can also be viewed as a spiritual successors of today’s open source infrastructure businesses (e.g. MongoDB, Elastic), but with the financial innovations of tokens & coins solving open source’s historical business struggles and unlocking far greater investment in open source software. Alongside breakthroughs in cryptography, developments within cloud computing and open source were arguably the key contributors to the development of modern crypto.

The driving force behind crypto as well as these related movements is that code and data benefit from being shared. Sharing code is simply more efficient as it prevents the need to rewrite from scratch. Unlike physical goods such as laptops or automobiles, once created there is very little additional cost compared to significant benefit for sharing with other people. Collectively sharing data is also more efficient, but for a different reason - by storing data in a shared public database (i.e. a blockchain), larger data sets can be created that are more accessible, easier to work with and ultimately more valuable than today’s data siloed datasets.

In the following discussions, the term “crypto” is used to refer to blockchains with smart contract capabilities, rather than more limited money-based applications like Bitcoin.

Crypto = cloud computing + open source + cryptography

Although crypto involves many complex technical innovations, it can be understood in a simplified way as the combination cloud computing, open source, and cryptography.

A blockchain with smart contract capability functions like a publicly hosted cloud, combining storage (the “blocks” in the blockchain) with compute (smart contracts). While a traditional cloud computing service is managed by a single 3rd party (e.g. Amazon for AWS), blockchains are managed collectively by a community (e.g. node operators in Ethereum). To enforce proper behavior from a group of the strangers managing the blockchain, some of whom could be malicious, cryptography and open source are employed as tools to protect data and code. Cryptography is used to ensure that malicious actors in a decentralized environment cannot modify data, such as editing, removing, or reordering blocks, without the changes being detected and rejected by the broader community. Open source code allows the broader community to monitor against unwanted changes as well as security vulnerabilities.

Cloud computing means renting other people’s machines

Cloud computing involves renting out remote machines to store your data and run your code, while using your computer and internet connection to control the machines.

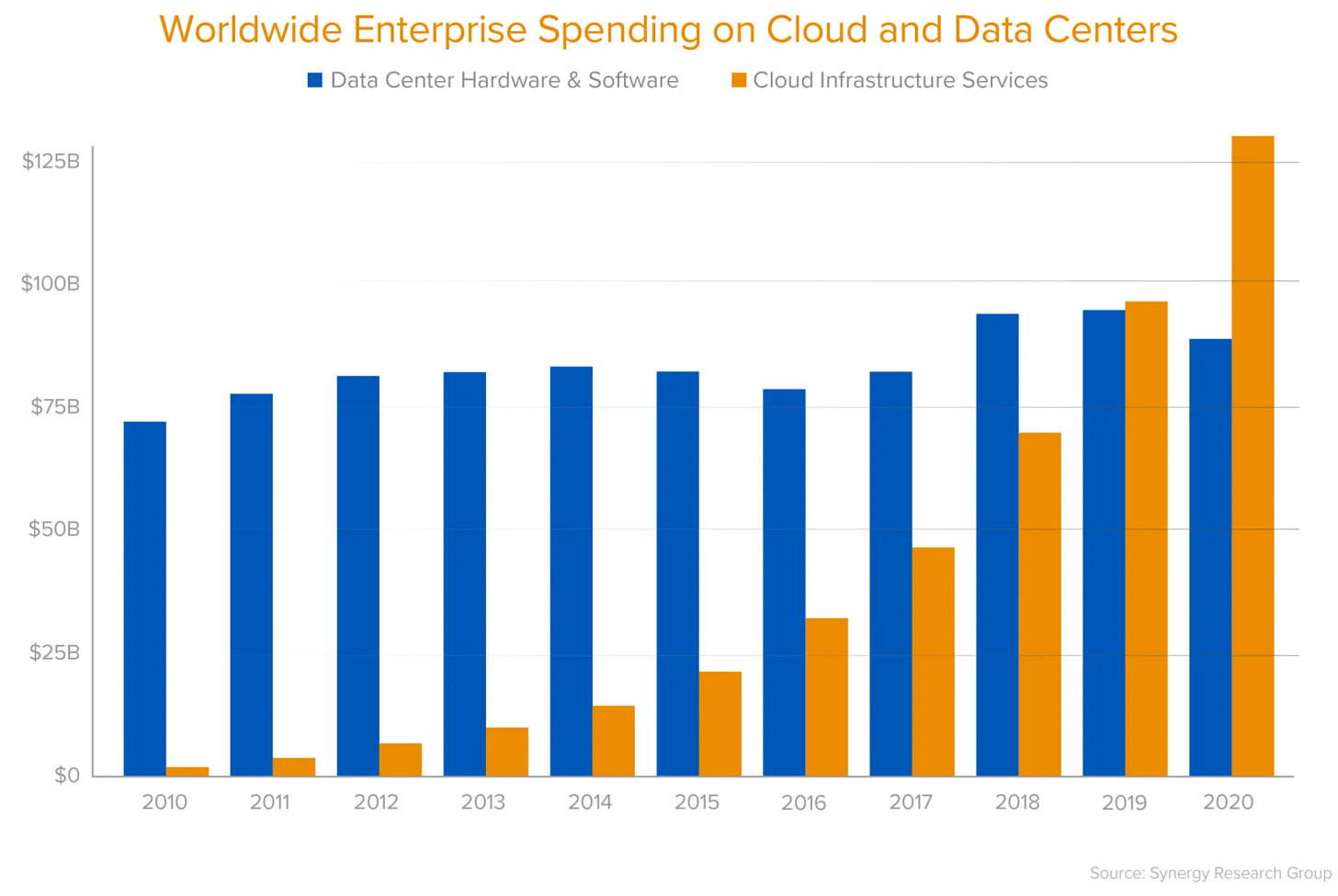

Before cloud computing, startups would spend weeks buying and setting up expensive on-premise servers. However using cloud computing individual developers can rent their infrastructure entirely over the internet, with only a few mouse clicks. In addition to significantly reducing the time required to get started, the transition has lead to a significant reduction in costs. Rather than paying for extra physical machines to help serve peak demand, cloud computing allows you to pay only for what you need, then ramp capacity up or down as needed. As such, the amount of capital necessary to begin a tech startup fell from $2.5 million in 1999 to as low as a few hundred dollars today1. Given this difference, it’s no surprise that adoption of cloud infrastructure has been growing rapidly, especially among startups2.

Blockchains are the natural next evolution of cloud computing

The “hyper-financialized” nature of crypto and the controversy it attracts often cause crypto to be perceived as some sort of odd cult movement disconnected from broader tech trends. Looking closely though and “crypto” looks a lot like a special case of cloud computing, which today is a boring but increasingly popular mainstream technology. Both actually developed in close historical proximity. While the beginning of modern cloud computing could likely be attributed to the formation of AWS in 2002, the whitepapers for Bitcoin and Ethereum were released in 2009 and 2013 respectively. The latter represented the first blockchain with smart contract capabilities, barely a decade after the founding of AWS.

Blockchain is the natural next evolution of cloud computing. By similarly relying other’s people devices for storage & compute, it inherits the low startup costs and fast onboarding of cloud computing. However by operating in the open and relying specifically upon “open source” as well as community-backed development, rather than closed source software owned by a single 3rd party, it gains additional benefits in the form of improved interoperability & composability.

Composability, the ability to easily combine different protocols and applications together, depends on code being open source and written in a modular way such that developers can easily build on top of each others’ work. From an outsider’s perspective, closed-source software is opaque, monolithic, and reduces collaboration because the hidden non-public code cannot be reused externally. This new “composability” enabled by blockchains makes building much easier and is the reason DeFi protocols are often called “DeFi legos”.

The end result of this evolution from cloud to blockchain is that software gets even cheaper and faster to build. Rather than writing your code from mostly scratch and then setting up as well as populating your own database, this new setup offers a pre-populated database (the blockchain) and modular open source code for you to build on top of (composability).

Crypto (more than) solved open source’s business struggles

Unlike cloud computing, open source has been around since the early days of computing. Open source projects originally weren’t intended as businesses, but more as protests against unfair profits and low quality software from closed source companies3. Linux, a long-time competitor to Microsoft first released in 1991, is an example of this approach. More recently, the rise of online repositories like Github have further supported the growth of free open source software.

Although open source is often associated with “free” (e.g. the “free and open source software”, or FOSS movement), open source strictly speaking means just that the code itself is visible to the public and can be freely modified. In recent years, the development of open source businesses has allowed open source to expand beyond “free”. Open source business struggled for years to make progress, as after Redhat’s IPO in 1999 there weren’t any major open source IPOs for years. In recent years, some infrastructure projects like MongoDB, Elastic, and Databricks have seen some degree of commercial success, although substantially less than the top public companies. For these projects, the lack of more effective business strategies meant the ability to re-invest profits in further development was limited.

Ironically in the course of adopting open source, crypto not only addresses this issue but takes things to the opposite extreme - hyper-financialization. Unlike its predecessors in open source infrastructure, blockchains don’t make money off of premium services (e.g. cloud hosting or enhanced support), but are often instead funded by their own native currencies. Ethereum and Bitcoin even today already have market caps of hundreds of billions, 10x the valuations of the next largest non-crypto open source projects. The result of this model is an excess of funding helping accelerate the development of open source blockchain projects. Crypto and open source have combined to form a powerful combination, though many proponents of “free” open source remain skeptical.

The relationship between crypto and open source is mutually beneficial, as open source also solves essential problems for crypto. Besides making it easier to spot security vulnerabilities and helping to build trust in projects, open source software makes it easier to collaborate on and develop communities around blockchain projects. In the original open source treatise “The Cathedral and the Bazaar”, it was stated that you should treat “beta-testers as if they're your most valuable resource”4. More than twenty years later, you can see hints in that for how blockchain projects treat feedback from Discord channels and attempt to cultivate communities.

The pursuit of efficiency inevitably leads to shared data and code

The fundamental driving force behind crypto is the pursuit of efficiency from shared code and data. If you can write open source code on top of a shared publicly hosted database, software becomes much easier and cheaper to write. If you can also monetize this software effectively using tokens or coins, then you can further invest to create even better software.

Since code has very little (almost zero) marginal cost once produced, sharing and re-using open source code was always going to produce more benefit with less cost compared to writing code from scratch, in a proprietary manner. The reason it had not taken off further was that open source code struggled to capture the “value” it created for users (being open and free to copy). As such, it was difficult to find money to re-invest into writing more code, the reason that open source has traditionally relied on volunteers and struggled to compete with closed source commercial software. With tokenization, the most significant barrier to broader open source adoption has arguably been overcome.

Data benefits from being “shared” as well. Data is generally the most useful when it is stored in a single location in a common format, rather than when that same data is stored in inconsistent formats across multiple silos. While siloed data needs to be retrieved, forced into a common format, then placed in a common location before being useful for analysis or model building, the shared ledger provided by blockchains entirely circumvents this problem. Although the full potential of this model won’t be fully apparent until blockchain scalability improves, large inteoperable ledgers will likely unlock information that is today trapped in data silos.

Shared code and data are simply better for efficiency, if you can make the business side and technology work out. Improvements in bandwidth & storage costs, advances in cryptography, and experiments in business models are only a few of the factors that have come together to enable crypto. While barriers remain to increasing adoption, ongoing experimentation motivated by these potential efficiency gains will likely lead to further improvements in time.

In the middle of a likely multi-year bear market, convictions can waver. Crypto is not a historical fluke, as its detractors often like to suggest. It’s the culmination of generational trends in tech that will continue to drive it forward in the coming decades, through many more bear markets and bull markets beyond this cycle.